Inflation vs Deflation - Round 1

First Deflationary Wave Hits North America.

Hi,

Welcome to Decade of 2020, a newsletter that relentlessly focuses on how the next 10 years will affect the middle class. Forewarned is forearmed, they say. If you’d like to sign up, you can do so here. Or just continue to read…

Early on in our lives, we learn how to connect real world objects with associated words by looking at images in a picture book. The electronic media has done something similar in brainwashing us to associate an image of a bull with a rising stock market and that of a bear with a falling one.

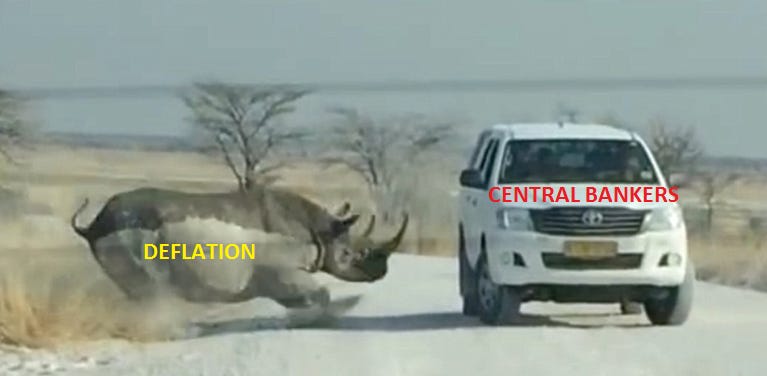

Let me re-introduce the RHINO - a fiercely powerful animal that seldom appears in the finance jargon but can do more damage than bulls and bears combined. It symbolizes a rarely seen phenomenon known as Deflation. Deflation is observed when we get more bang for our bucks. With deflation, a currency becomes more valuable because its purchasing power goes up in relation to goods and services. With inflation, it’s the exact opposite.

The narrative being woven by the media today is that these two forces are butting heads against each other and neither of them seems to be winning this battle. Words of the Chief Investment Officer at Artemis Capital paint a vivid picture for us:

The spectacular stupidity of the central bankers is why we find ourselves in this situation but let’s leave that for a separate, long and boring discussion - very much like the lives of the central bankers themselves.

“Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist.”

From The General Theory of Employment, Interest and Money (1936 Ed.) by John Maynard Keynes.

Based on my research and what I wrote last time, I find myself fairly and squarely positioned inside the deflationista camp. To prove my point, let’s survey the current carnage first:

Early casualty: Retail

Just as the corona virus instigated a country wide lockdown in US and Canada, long decomposing corpses of grotesquely fragile, highly leveraged businesses were first in line demanding to be body-bagged.

Let’s see who all were the notable actors in this first act - so far:

US based

JC Penney

J. Crew

Neiman Marcus

Victoria’s Secret & Bath & Body Works (closing 250 stores overall, 13 in Canada)

Roots USA

True Religion

Modell's Sporting Goods

Canada based

Pier 1 (shuttered its entire 540 stores in Canada)

Reitmans

Aldo Footwear

Papyrus Cards

Bench

Bose (closing all Canadian outlets)

Things Engraved

Ten Thousand Villages Canada (shut its operations after being in business for 75 years)

There seems more terrible news is in store for the malls, no pun intended. And yeah, their woeful owners too. If your recent stock portfolio statement shows that you hold REITs, do your research on what’s inside the box and check if anything stinks.

Also, this year’s Black Friday is going to be EPIC with some deep discounts! It might even arrive early.

Victims of the so called “Oil Price War”

2020 wasn’t turning out to be a great year for the lead actors of the OPEC+ cartel, Saudi Arabia and their buddy Russia. See chart below. Then, their common largest customer began shutting down its economy toward the end of January and into February. OPEC and Russia, with their GDP’s heavy reliance on oil revenues found themselves in a tight spot.

To make matters worse, the OPEC+ oil hegemony has been challenged for some time by the rapid technological developments and innovation that the shale oil firms have brought along, who in turn have survived lower profitability due to ultra-low interest rates.

Desperate for oxygen, OPEC+ decided to do what it knows best - flood the world with oil.

In March, the narrative that was sold by the Western media was Russia and the House of Saud were having a battle to control market share and it had manifested into a price war. Pretty convenient explanation except it was false. I was dumbstruck to observe that some of the smartest minds I knew had bought into it without questioning the very soundness of the logic and while forgetting this symbolic high-five at the G20 Summit in Nov 2018.

“The lion cares less about being king of the beasts than about finding his dinner.”

Mason Cooley, American Aphorist

In my understanding, the two were blatantly colluding against their common enemy: the landlocked American shale oil. The ill-fated bystander who got sucked into the vortex was none other than Alberta’s Heavy oil (WCS) - the second largest supplier of oil to US refineries.

Given the Western ruling elites were asleep at the wheel as usual or busy worrying about their own stock holdings, OPEC+ was wildly successful. Their timing wasn’t bad either. As the game progressed, the world witnessed negative oil prices for the first time ever and shale oil firms topple like dominoes - one of them being Whiting Petroleum (WLL). The Oracle of Omaha, Warren Buffett, couldn’t have imagined his contrarian bet in Occidental getting caught up in a messy game of geopolitics. Occidental's debt rating suffered a triple downgrade - one of the rare actions of honesty by the “saintly folks” over at Fitch Ratings.

The US administration ultimately stepped in and beat KSA on the head to remind them that it was in fact the US military that was defending them from the mortal threat in their neighborhood. But by then, deep damage had already been inflicted in the Permian, the highest oil producing basin in the world. Sounds deflationary?

Hertz et al

Zombie rental car companies like Hertz have launched a fire sale in a desperate attempt to convert their clunkers into cash. Why, you may ask? Bankruptcy means you still have to repay the creditors. Well, not all of them haha!

“It is the debtor that is ruined by hard times.”

Rutherford B. Hayes, 19th President of the United States.

For example, if you were to search AutoTrader for your dream Chevrolet Corvette Z06s, you would find a bunch of them listed at deep discounts - 2019 models, to be precise. These fancy toys once belonged to Hertz’s fleet geared toward the high-flying, high-paying customer. As of this week, they are selling between $58,000 to $63,000, far below their Kelley Blue Book $76,938 to $85,275 “fair value range”. It must be noted that there are more than half a million cars that are still on Hertz’s inventory.

Jokes apart, many of us who are cursed with the ability of second-order thinking might ask - “Holy shit! How does this cascade?” To which the answer is plain and simple - it cascades vertically backward to the automakers and downward to the dealerships. The bizarre disconnect is that automakers are desperate to re-open their factories and start building cars again. Beginning of 2020, Ford & GM had already extended themselves to the farthest ends by offering payment plans from 72 up to 96 months at 3.49% APR. I learnt that upon reopening the dealerships have begun offering a 90 day payment holiday as a lollipop. I am not so sure it’s going to work with most people living off of government stimulus checks or in self-preservation mode.

What do the car makers do now to entice customers - offer 100 month, zero percent interest loans? Maybe. So, if you aren’t in too much of a rush to buy a second car, wait till the fall; there may be some mouthwatering deals forthcoming.

Age of the “Make-believe”

The media has and will continue to act its part to persuade us that everything will get to normal very soon and that prices will stabilize. Unfortunately, it doesn’t work like that. Businesses are always fast to fire and excruciatingly slow in re-hiring. It is not the end of times and things will eventually get better but not at the pace that most imagine. I urge everyone invest their eggs accordingly.

When Rome fell, Odoacer said that Rome endured. He, along with almost everyone else, was keen to pretend that nothing had changed. They knew that "the glory that was Rome" was far better than the barbarism that was taking its place. Even the barbarians thought so. As C. W. Previte-Orton wrote in The Shorter Cambridge Medieval History, the end of the fifth century, when "the (Roman) Emperors had been replaced by barbaric German kings," was a time of "persistent make-believe."

From The Sovereign Individual by James Dale Davidson & Lord William Rees-Mogg.

Believe me or don’t, but do pay close attention to the narrative you are being fed, how is it being presented, and more importantly, observe how it shifts over time.

“My Sunday school teachers had turned Bible narrative into children’s fables. They talked about Noah and the ark because the story had animals in it. They failed to mention that this was when God massacred all of humanity.”

From Blue Like Jazz by Donald Miller.

Lastly, I wish to draw your attention to this clip from the movie 2012. The first 40 seconds are solid gold! As morally bankrupt and superficial Hollywood is, it doesn’t fail to warn us all once in a while - by blending absolute truth within hyperbole. Don’t miss it! Stay safe!

A good read. Especially since it highlights the need to fact check and analyze and not just believe the narrative fed. Since we in North America are already in the realm of disinflation, it could very well progress into a deflation. It would be prudent to give a deeper thought as to who the protagonist in this drama are though.

Very informative, specially the content is the king in this piece, and someone like myself not from a finance background was able to understand the narrative of the writer. Way to go !!!!